The recently introduced

proxy hedge model and corresponding

empirical proxy quantiles share an implicit dependence on the

joint covariation between underlying and proxy hedge. Of particular interest is understanding the dynamics of

basis risk under extreme scenarios (both up and down), which are driven by time-varying stochastic joint covariation.

This post quantifies and visualizes such joint covariation and basis risk via

copulas, including modeling and empirically fitting both marginal and joint distributions using fat-tailed

student-t

distributions. Copulas exploit multidimensional sample ranking, and

thus are thematically similar to empirical quantiles. This analysis also

seeks to exemplify practical use of R for copula analysis.

Brief review of the shortcomings of classic

dependence statistics (such as correlation and covariance) motivates use of copulas and related techniques:

- Normality: assumption of joint normality in one guise or another, irrespective of suitability

- Summary statistics: point estimates which reduce complex covariation relationships into single numbers

- Marginal-joint conflation: considerations of both marginal and joint are conflated, rather than providing clean and independent separation

- Poor visualization: few visualization techniques exist, reducing potential for geometric and topological intuition

These shortcomings were resolved by the following beautiful decomposition, due to

Sklar (1959):

where

and

are univariate distributions,

is a two-dimensional distribution function with marginal distributions

and

, and

is a copula. Note that any or all of

,

, and

may be fitted empirically.

Trivedi and Zimmer (2005) or

Cherubini et al. (2004) are suggested for readers unfamiliar with copulas.

Conceptually, this technique provides several useful benefits for analyzing proxy hedging basis risk:

- Mechanics: Any joint distribution can be bi-directionally “glued together” by two marginals and a copula

- Uniqueness: Copula is unique, under conditions reasonable for current purposes

- Completeness: Joint covariation can be fully characterized by a copula, independent from the marginals

- Visualization: Copulas can graphically visualized, in both contours and density plots

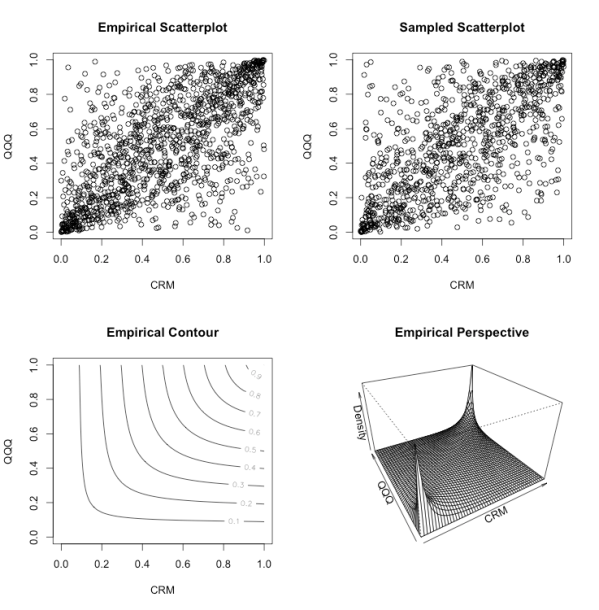

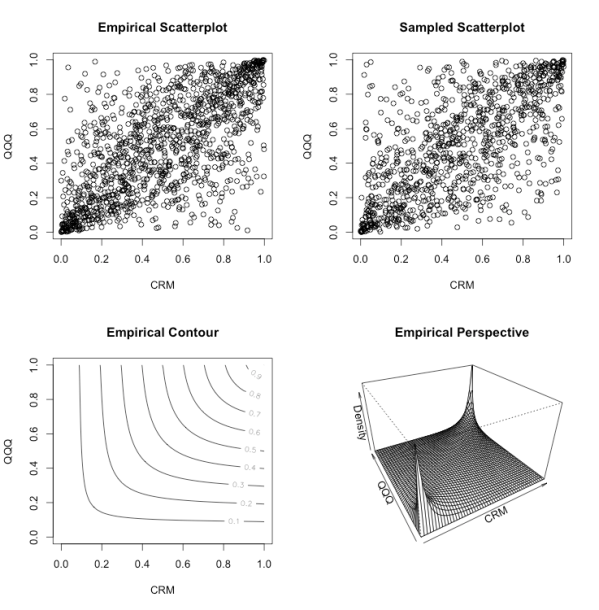

Without further ado, the following plots visualize the daily joint

covariation of well-known tech stock and QQQ linear returns over the

longitudinal period via an

empirical proxy copula (1254 daily observations), as introduced in

Empirical Quantiles and Proxy Selection. Note these plots illustrate

joint covariation independent from the marginal densities of CRM / QQQ:

The top left plot illustrates scatter of ranked pseudo observations;

top right illustrates scatter of 1000 random samples from the fitted

copula; bottom left illustrates empirical copula contour; and bottom

right illustrates the empirical copula perspective. Compare this

diversity of visualization versus a single number (

e.g. correlation statistic, which happens to equal

0.777).

Diving into the marginal and copula distribution is necessary to

understand this relationship further. Consistent with standard

convention, all distributions are assumed to be student-t with

empirically fitted degrees of freedom. The parameters of the marginals

are:

CRM location 0.0003 scale 0.0218 df 3.489

QQQ location 0.001 scale 0.0100 df 2.767

Indicating the marginal distributions diverge strongly from normality

with fat trails, due to small degrees of freedom. This matches the 3 df

estimate by Schoeffel in his

recent (2011) article on futures (note difference in frequency and log returns).

Similarly, the copula is assumed to be distributed student-t with estimated df of

3.975 and

of

0.6868. The bivariate association measures for the empirical proxy copula are:

tau 0.481

rho 0.669

tail index: 0.381 0.381

Indicating the copula also strongly diverges from normality with strongly fat tails.

In summary: these plots and fitted distributions confirm observed conclusions from the

previous post: although CRM and QQQ covary, there is

high basis risk—including

numerous observations with nearly inverse correlation. In other words, a

QQQ proxy is likely to result in fairly costly hedging errors.

R code to generate the above empirical proxy copula analysis (and more, possibly to be covered in a subsequent post):

004 | exploreProxyDist <- function(p, doExcess=TRUE, partitions=1) |

016 | oldpar <- par(mfrow=c(2,2)) |

020 | pROC <- ROC(p, type="discrete", na.pad=FALSE) |

021 | exploreProxyDistROC(pROC) |

025 | frac <- floor(n / partitions) |

026 | sapply(c(0:(partitions-1)), function(p) { cat("\n", |

027 | (p+1),"-th partition:",((p*frac)+1), |

029 | partition <- pROC[((p*frac)+1):((p+1)*frac),] |

030 | exploreProxyDistROC(partition) } ) |

035 | cat("\nExcess Copula\n") |

038 | excess <- pROC[,1] - pROC[,2] |

039 | excessROC <- cbind(excess, pROC[,2]) |

042 | plot(cumprod(1+excess), main="Excess Cumulative Returns", ylab="Return") |

043 | oldpar <- par(mfrow=c(2,2)) |

045 | exploreProxyDistROC(excessROC) |

049 | frac <- floor(n / partitions) |

050 | sapply(c(0:(partitions-1)), function(p) { cat("\n", |

051 | (p+1),"-th Excess Partition:",((p*frac)+1), |

053 | partition <- excessROC[((p*frac)+1):((p+1)*frac),] |

054 | exploreProxyDistROC(partition) } ) |

061 | exploreProxyDistROC <- function(pROC) |

071 | cnames <- colnames(pROC) |

074 | p1Fit <- fitdistr(pROC[,1], "t")$estimate |

075 | p2Fit <- fitdistr(pROC[,2], "t")$estimate |

077 | cat(cnames[1], "location", p1Fit[1], "scale", p1Fit[2], "df", p1Fit[3], "\n") |

078 | cat(cnames[2], "location", p2Fit[1], "scale", p2Fit[2], "df", p2Fit[3], "\n") |

081 | tau <- cor(pROC, method="kendall")[2] |

082 | t.cop <- tCopula(tau, dim=2, dispstr="un", df=3) |

083 | psuedo <- apply(pROC, 2, rank) / (n + 1) |

084 | plot(psuedo, main="Empirical Scatterplot", xlab=cnames[1], ylab=cnames[2]) |

086 | fit.mpl <- fitCopula(t.cop, psuedo, method="mpl", estimate.variance=FALSE) |

091 | empiricalCopula <- tCopula(fit.mpl@estimate[1], dim=2, dispstr="un", df=fit.mpl@estimate[2]) |

092 | plot(rcopula(empiricalCopula, 1000), main="Sampled Scatterplot", xlab=cnames[1], ylab=cnames[2]) |

093 | contour(empiricalCopula, pcopula, main="Empirical Contour", xlab=cnames[1], ylab=cnames[2]) |

094 | persp(empiricalCopula, dcopula, main="Empirical Perspective", |

095 | xlab=cnames[1], ylab=cnames[2], zlab="Density") |

097 | cat("Empirical tau:", kendallsTau(empiricalCopula), "\n") |

098 | cat("Empirical rho:", spearmansRho(empiricalCopula), "\n") |

099 | cat("Empirical tail index:", tailIndex(empiricalCopula), "\n") |

101 | return (list(fit=fit.mpl, copula=empiricalCopula)) |

No comments:

Post a Comment

Thank you